Purpose-Built Solutions To Power Your Practice.

Watch Our Video

Right Investment Tools

Capital Market Advisors (CMA) is an independent, employee-owned investment solutions provider built for advisors, by advisors. We offer flexible, scalable investment solutions designed to support your business—whether you're looking to enhance your current offering or outsource key elements of portfolio management, we have the right tools for your business and your clients.

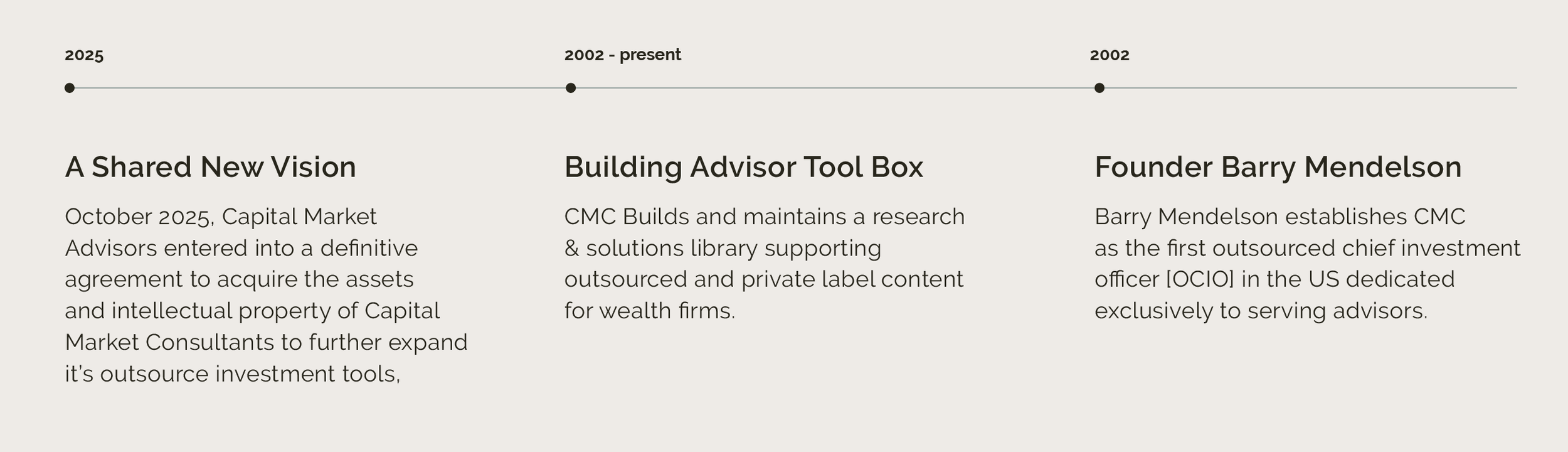

Rooted in fiduciary standard, our history reflects a commitment to providing the tools and insights wealth advisors need to put clients first.

Advisors that use outsourced investment tools and OCIO

services are able to grow faster, lower operating expenses, and streamline their operations while driving higher practice values.

By uniting CMA with sibling companies under UP Capital, we combine innovation, technology, and market expertise into a single, powerful platform for wealth advisors.

Employee owned. Technology enabled. Client focused.

UP Capital is building a toolbox of outsourced investment solutions that empower wealth advisors to better serve their clients.

Our Managed Solutions deliver flexible, customized, and professionally managed tools to meet diverse client needs.

We provide a comprehensive suite of investment tools—Direct Indexing, Manager Select, Fund Allocation Portfolios —designed to meet the evolving needs of wealth advisors and their clients. Each solution is built to combine flexibility, efficiency, and professional oversight, making it easier to deliver personalized strategies at scale.

DIRECT INDEXING

A customizable investment approach that replicates an index while allowing for tax optimization and personalization around values, sectors, or risk exposures.

FUND ALLOCATION PORTFOLIOS

Professionally constructed portfolios blending mutual funds and ETFs to deliver diversified, risk-aligned solutions across asset classes.

MANAGER SELECT

A platform providing access to carefully vetted third-party asset managers, giving advisors flexibility to choose specialized strategies for their clients.