INVESTMENT PROCESS

Thorough Due Diligence and Insight

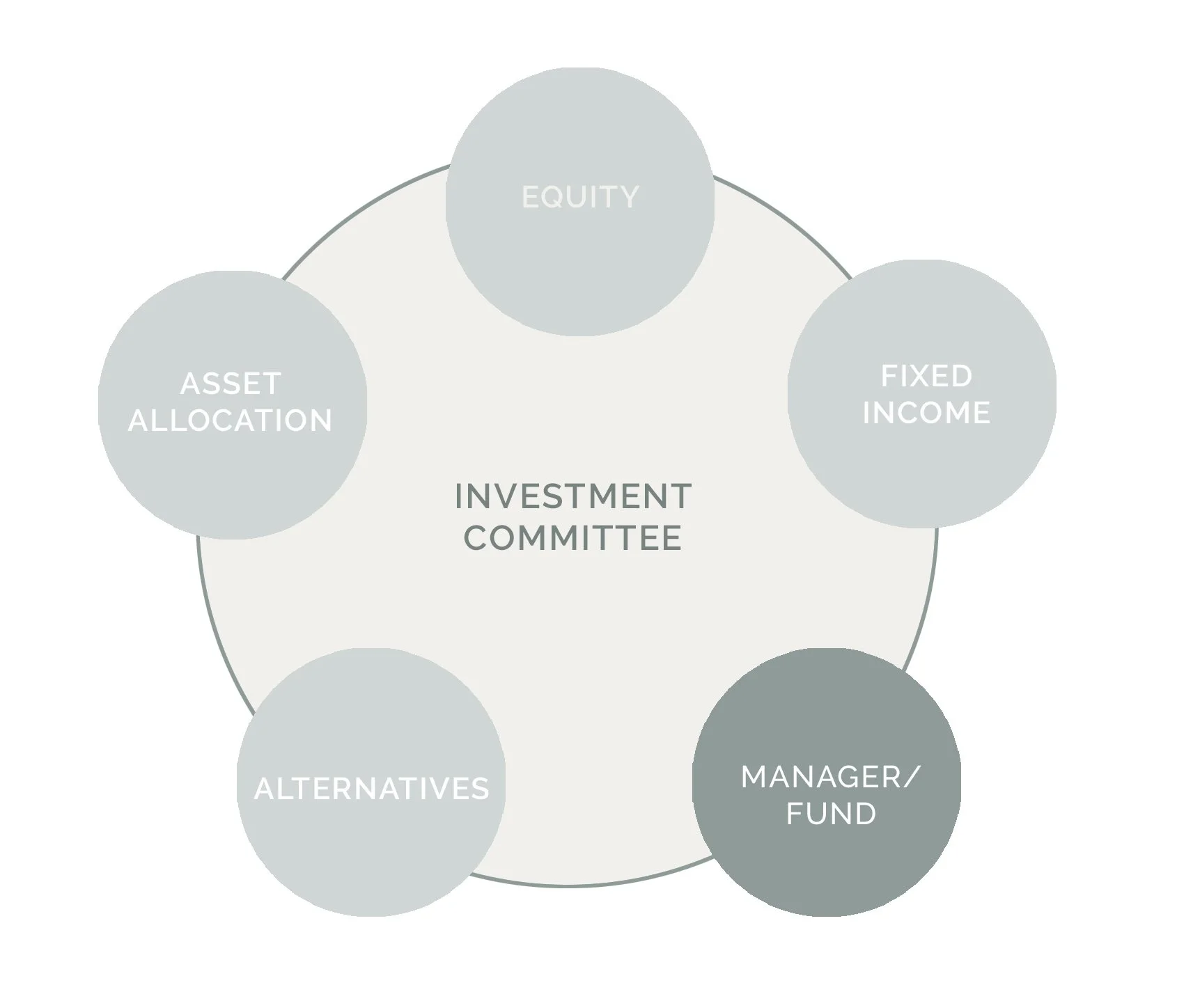

Our Manager/Fund Research Team is responsible for sourcing, evaluating, and monitoring investment managers and funds across asset classes.

We combine proprietary analysis with external resources to identify managers who demonstrate a repeatable investment process, disciplined risk management, and strong alignment with client objectives.

The selection process emphasizes both quantitative and qualitative factors, including performance consistency, portfolio construction discipline, organizational stability, and the depth of investment talent. We also evaluate risk-adjusted returns, style consistency, and adherence to stated mandates.

Ongoing monitoring is central to our approach. Managers and funds are reviewed regularly to ensure they continue to meet our standards. Changes in investment philosophy, personnel, organizational structure, or risk/return profile may result in a recommendation to reduce or eliminate an allocation.

Our goal is to construct portfolios that reflect our best ideas, blending managers and funds that complement one another while helping clients achieve diversification, risk control, and attractive long-term outcomes.