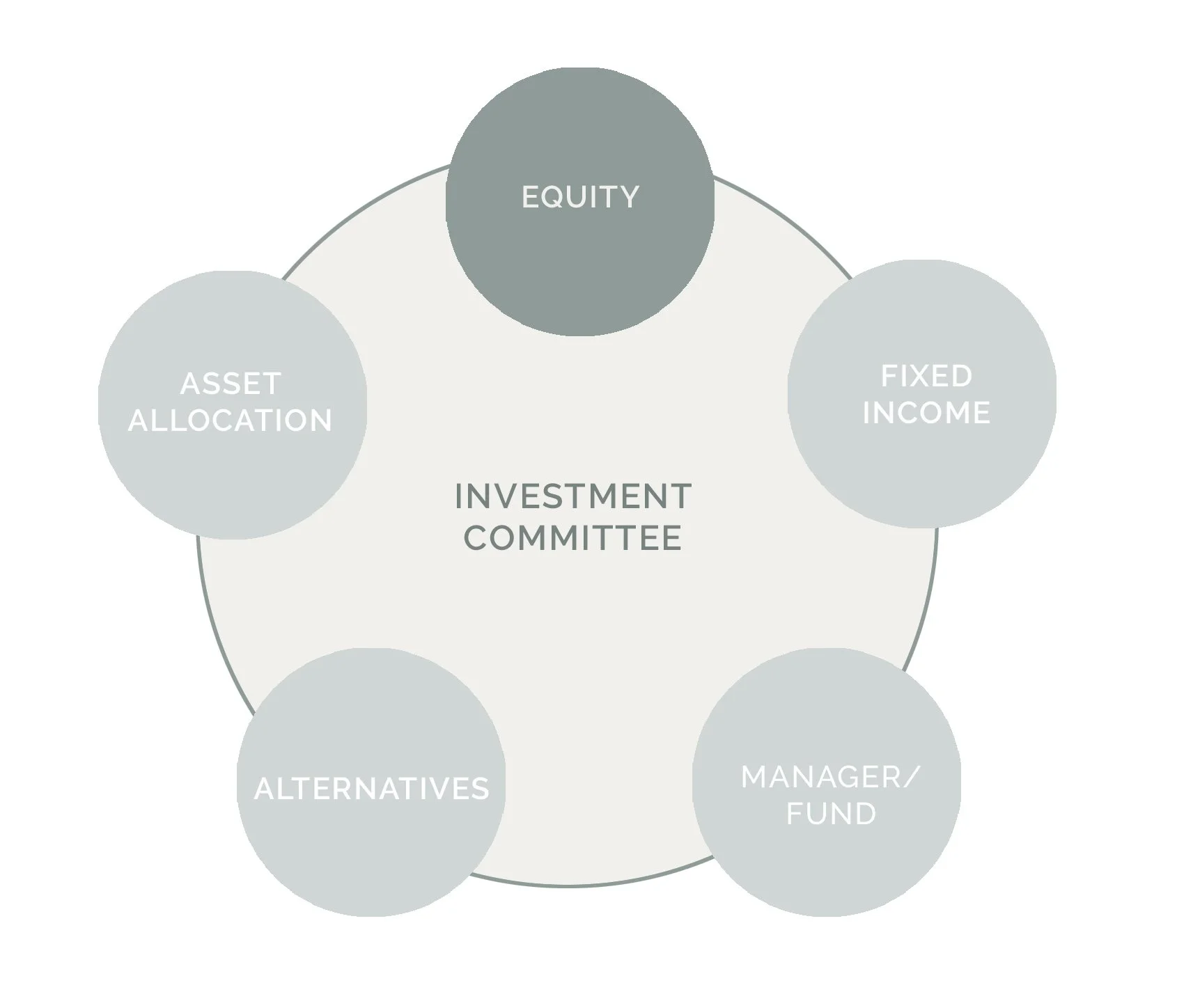

INVESTMENT PROCESS

Comprehensive Risk and Expert

Analysis

The Equity Team focuses on manager selection and risk management.

The primary objective of our research process is to identify best in class managers. The process is designed so that security selection and not sector allocation or industry concentration is the primary driver of performance over long-term periods.

Strategies exhibit a high-quality bias with moderate turnover. We focus on quality through the lenses of balance sheet strength, full-cycle profitability, cash flow-based valuation, and business model durability.

Additionally, we assess the industry competition landscape, management experience, corporate governance policies, supplier concentration, customer concentration, and supply chain risks for all of our portfolio holdings and candidates

The equity team regularly reviews the historical and expected impact of macroeconomic variables including interest rates, currency valuations, and oil prices on the strategies. The team also regularly reviews the portfolio’s exposures to style factors including style, size, beta, leverage, quality, momentum and value.

We partner with the Morningstar’s Equity Research Service for access to industry and company experts, who help our Equity Team evaluate the prospects and risks for current holdings and candidates on an ongoing basis.