ABOUT

Investment

Committee

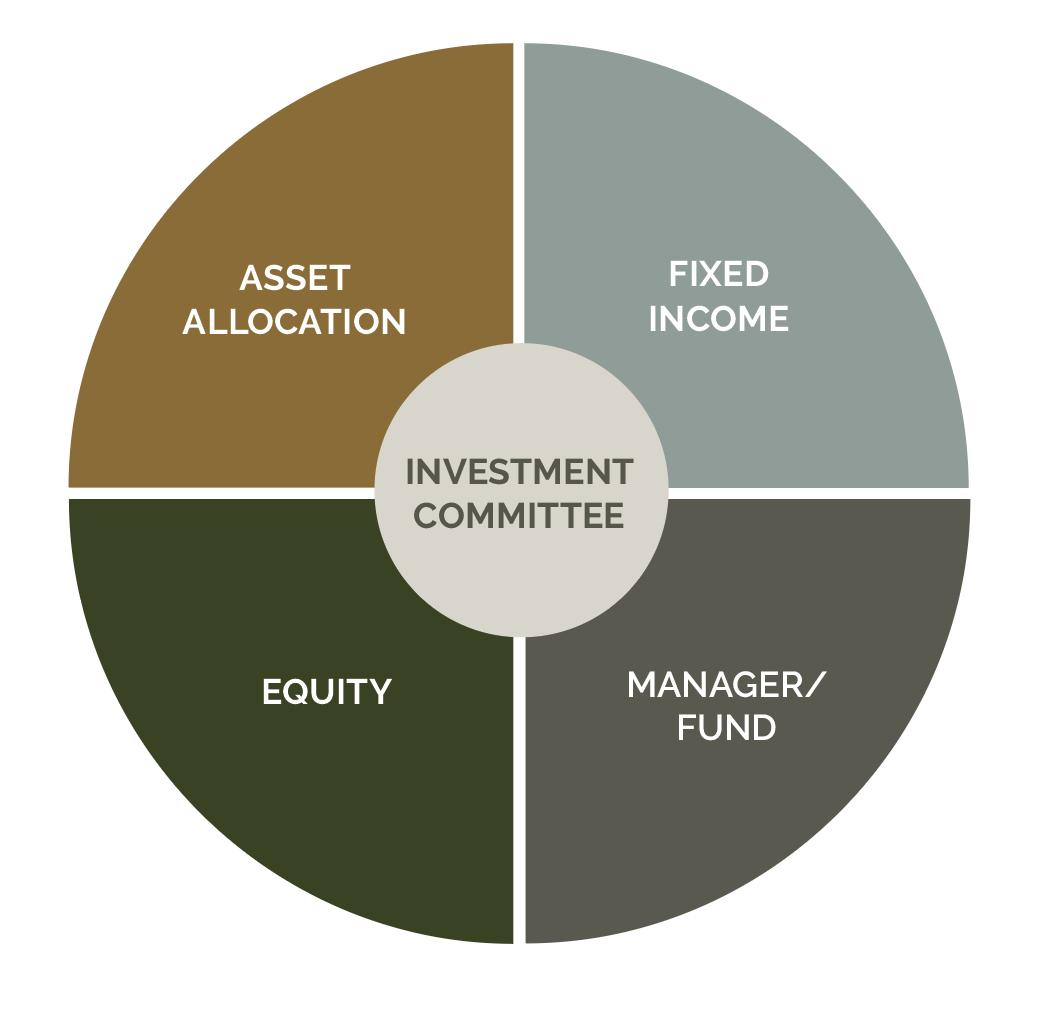

At Capital Market Advisors, our team delivers the tools to help develop strategy, analysis, and decision-making processes to drive efficiencies in your operations.

Our Investment Committees are designed to be a collaborative forum focused on aligning investment outcomes with your client expectations. We value the expertise, insight and contributions of each team member.

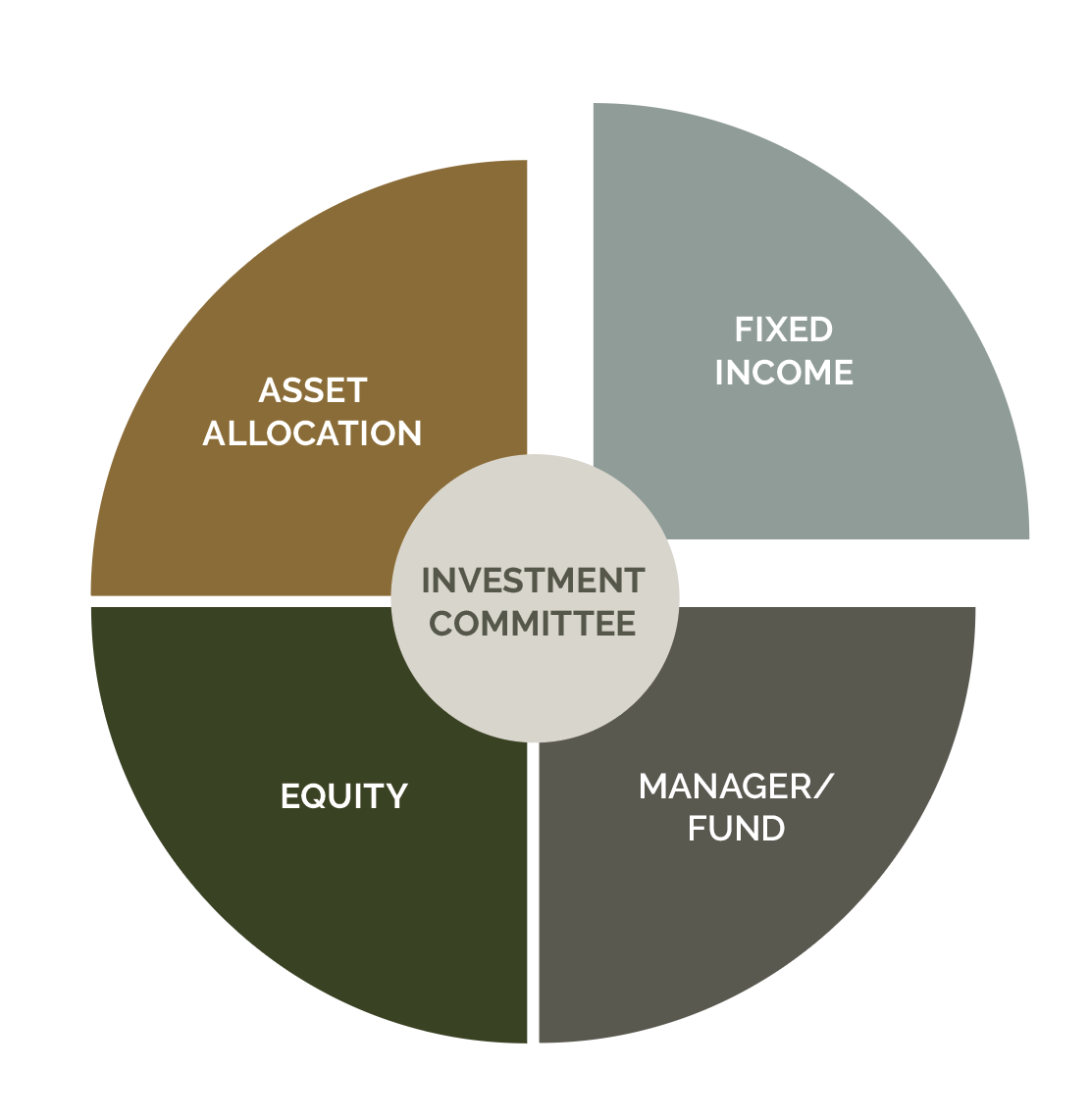

Asset Allocation

The Asset Allocation Team is responsible for developing strategic asset allocation targets and ranges for varying levels of risk/return.

Asset classes included in our investment objectives are those identified by the Asset Allocation Team. The Asset Allocation Team uses a variety of tools to analyze historical risk, return and correlation data as well as forward-looking estimates. This analysis informs the development of optimal target weights and ranges for our investment objectives.

Fixed

Income

The Fixed Income Team is responsible for providing guidance and recommendations with respect to the construction of fixed income allocations and strategies.

Asset classes included in our investment objectives are those identified by the Asset Allocation Team. The Asset Allocation Team uses a variety of tools to analyze historical risk, return and correlation data as well as forward-looking estimates. This analysis informs the development of optimal target weights and ranges for our investment objectives.

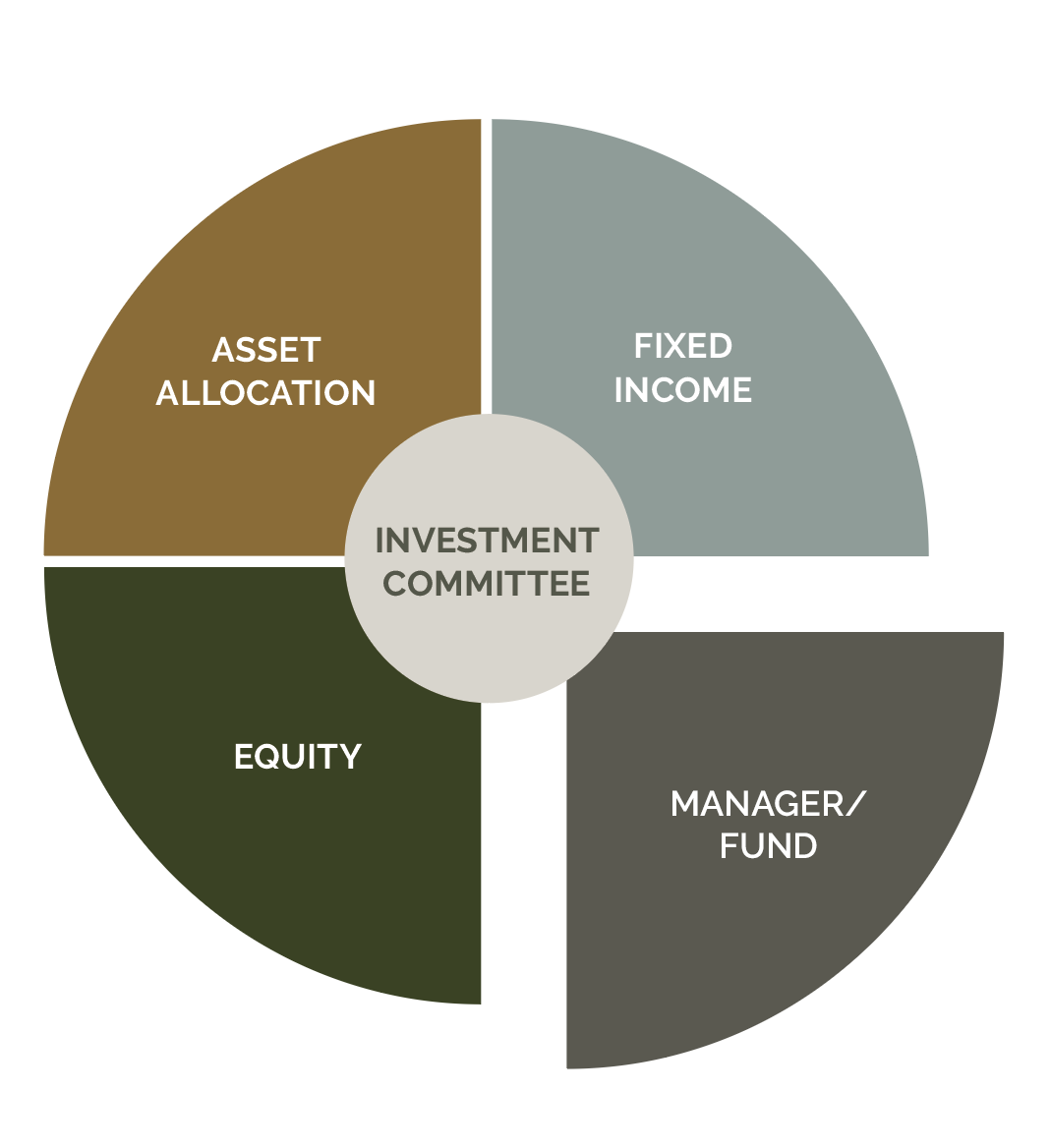

Manager/Fund

Our Manager/Fund Research Team is responsible for sourcing, evaluating, and monitoring investment managers and funds across asset classes. We combine proprietary analysis with external resources to identify managers who demonstrate a repeatable investment process, disciplined risk management, and strong alignment with client objectives.

The selection process emphasizes both quantitative and qualitative factors, including performance consistency, portfolio construction discipline, organizational stability, and the depth of investment talent. We also evaluate risk-adjusted returns, style consistency, and adherence to stated mandates.

Ongoing monitoring is central to our approach. Managers and funds are reviewed regularly to ensure they continue to meet our standards. Changes in investment philosophy, personnel, organizational structure, or risk/return profile may result in a recommendation to reduce or eliminate an allocation.

Our goal is to construct portfolios that reflect our best ideas, blending managers and funds that complement one another while helping clients achieve diversification, risk control, and attractive long-term outcomes.

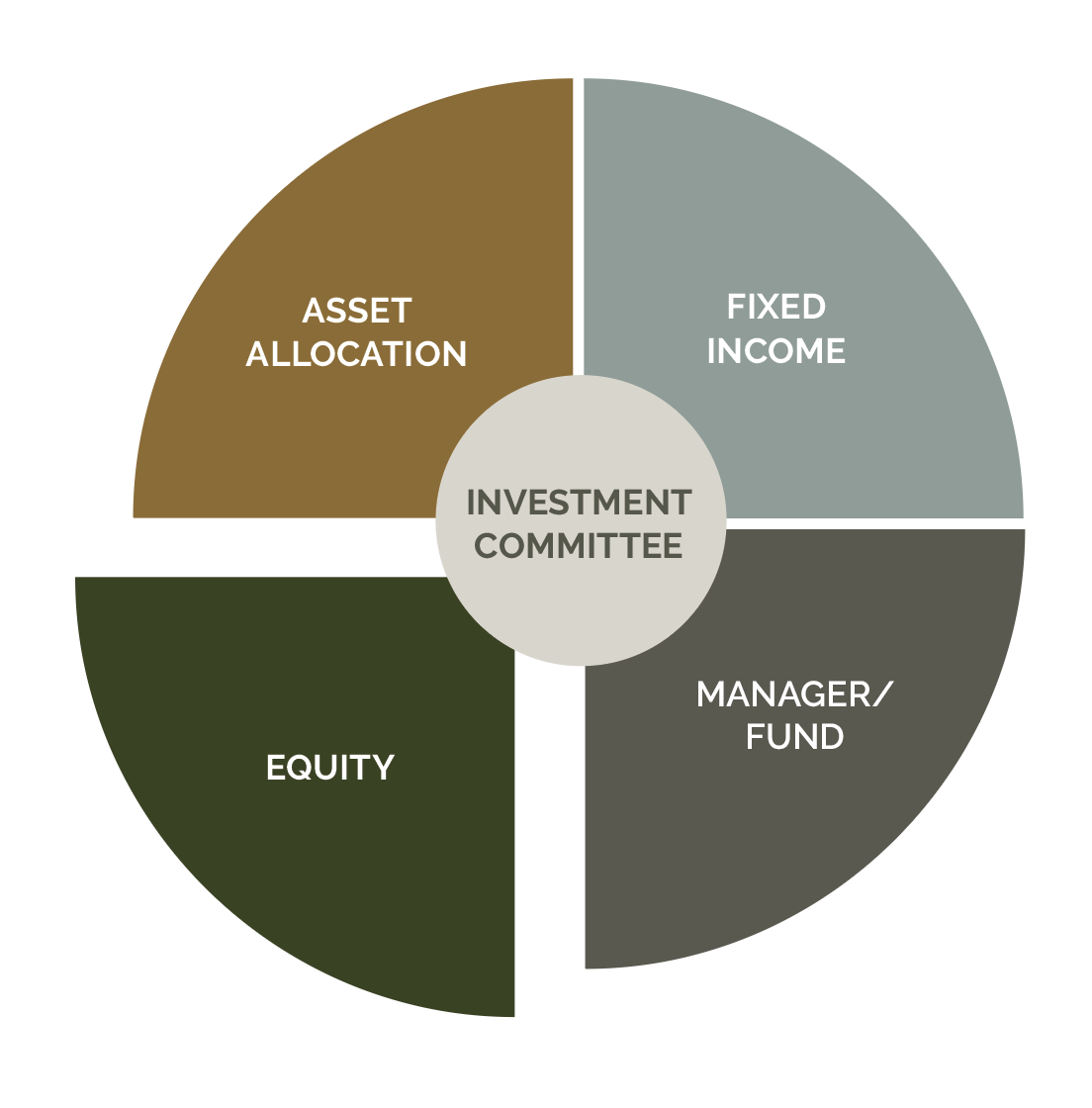

Equity

The Equity Team is responsible for identifying managers for our managed portfolios utilizing both proprietary and external research to identify candidates. The goal of our equity selection process is to build high-quality, relatively concentrated, low turnover equity portfolios composed of managers that represent our best ideas.

Sell decisions are often precipitated by deterioration in the underlying financial statement trends including balance sheet quality, operating profitability and efficiency. A portfolio holding that exhibits absolute or relative valuation metrics deemed excessive by our equity strategy team can also result in a sell decision. Additionally, management changes, reputational risks and competitive threats deemed material by our equity teams can lead to the sale of a portfolio holding. Finally, holdings that experience protracted periods of under-performance can be sold as a risk control measure.